Table Of Content

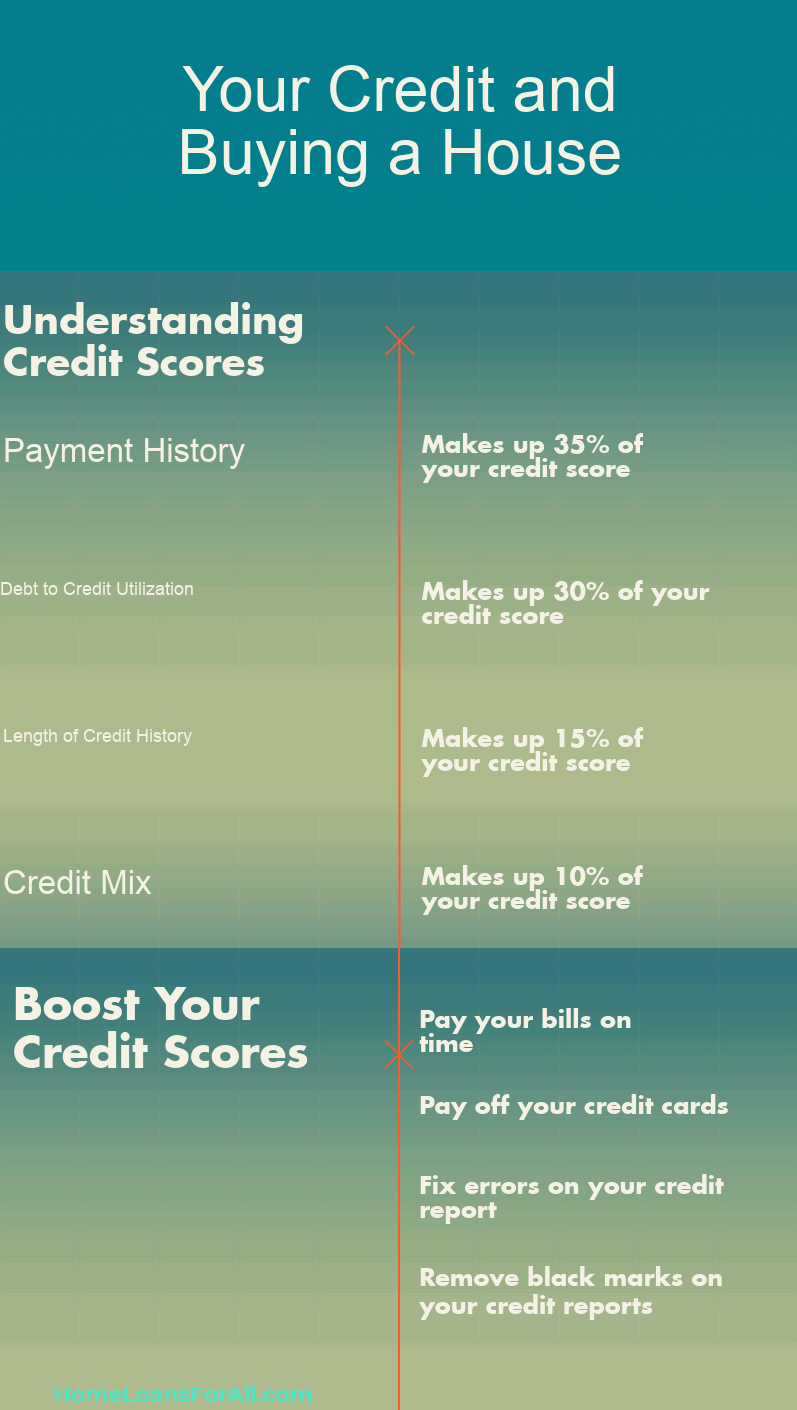

This includes the length of your credit history, payment history, and types of credit used. A longer and more diverse credit history typically signifies to lenders that you are a responsible borrower. To put yourself in the best position to qualify for a mortgage and improve your credit score to buy a house, focus first on these areas.

Improve Your Credit Before Buying a House

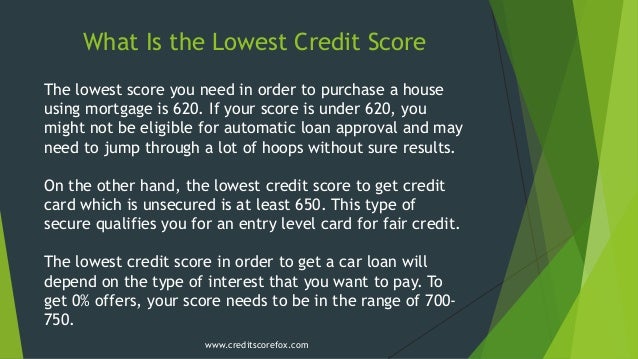

Two major government-backed programs offer zero-down payment mortgages, although the individual lender will have certain credit score requirements that you’ll need to meet. VA loan lenders typically require a minimum score anywhere between 580 and 620. Intended for borrowers with low-to-average income for their area, these loans provide 100% financing with reduced mortgage insurance premiums, often at below-market interest rates. The purchased home must be in a "rural" area, with lenders typically requiring a credit score from 520 to 640.

Mortgage

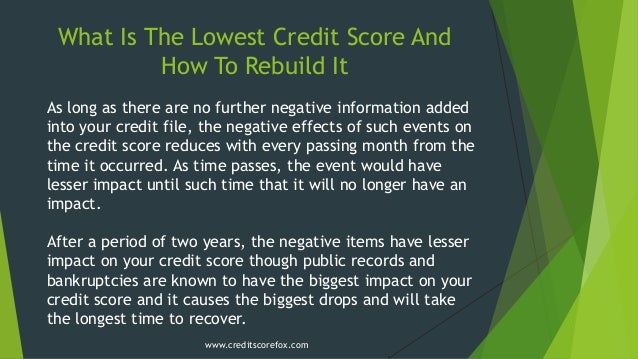

However, you’ll have fewer options and could pay more for your loan. If possible, consider postponing your home purchase until you’re able to improve your credit score. Doing so could save you tens of thousands of dollars over the duration of your loan. As of Aug. 13, 2022, there were more than 29 million Credit Karma members with mortgages. Among this set, the average VantageScore 3.0 credit score is 705 and the median is 725.

Take the first step toward the right mortgage.

The higher your score, the more responsible of a borrower you’ll appear to mortgage lenders. Keep in mind that for the purposes of your interest rate and mortgage insurance, the lowest median score is the one that gets reported, which could raise your rate slightly. There are also certain situations in which Fannie Mae would still use the lowest middle score for qualification. Speak with a Home Loan Expert if you have questions about the credit score you’ll need to qualify for a mortgage. Before we get into the credit score you’ll need to qualify for a mortgage, you might be wondering how lenders determine your credit score. After all, your FICO® Score is reported by three different credit bureaus.

In most cases, a FICO Score and a credit score are similar, but there are several differences when you scratch the surface and try to estimate your mortgage rate. The higher your credit score, the more likely you are to both qualify for a mortgage and for one at a lower interest rate. If you have closed accounts, one of the best ways to re-establish credit is with a secured credit card, usually issued by a credit union or local bank. The institution will require you to maintain a set amount in an account to offset any activity on the new account.

Credit scores are maintained by the national credit bureaus and include debt like credit cards, auto loans or student loans. If you’re interested in a non-QM loan, check out the specialty mortgage programs some banks and credit unions offer that are neither conventional loans nor government-backed. Or, work with a mortgage broker who can recommend products from various lenders that might fit your needs. FHA loans are a strong option if you’re seeking home loans with bad credit.

What Is An FHA Construction Loan? - Bankrate.com

What Is An FHA Construction Loan?.

Posted: Mon, 01 Apr 2024 07:00:00 GMT [source]

Texas, on the other hand, has a lot of cities with homeowners who have lower average credit scores. When it comes to credit cards, Ted Rossman, senior credit card analyst at Bankrate, advises keeping a laser focus on your credit utilization ratio. This represents the limit on your cards versus how much of your credit you’re actually using.

Guide to Credit Scores and Credit Score Ranges - NerdWallet

Guide to Credit Scores and Credit Score Ranges.

Posted: Tue, 21 Nov 2023 08:00:00 GMT [source]

Compensation may factor into how and where products appear on our platform (and in what order). But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That’s why we provide features like your Approval Odds and savings estimates. Review the reports and identify negative items impacting your credit health, so you know what to focus on first. Also, dispute any errors you find with the credit bureaus and creditors to have them rectified. Before taking the next steps toward improving or fixing your credit health, it’s vital to understand how your credit score is calculated.

Treasury & payment solutions

This process not only evaluates your credit score to buy a house but also gives you a verified answer about your home buying prospects. For a conventional mortgage, a modest credit score of 620 is typically sufficient, with just a 3% down payment. A large part of what a lender wants to see when they evaluate your credit is how reliably you can pay your bills. This includes all monthly payments, not just auto loans or mortgages – utility bills and cell phone bills matter, too. Your credit score is a number that’s used to indicate your creditworthiness.

In the meantime, your scores help you understand where you might fall on the spectrum as a potential borrower. A free credit report does not show a lender enough information to approve you for a mortgage loan. This type of credit report shows what is called "consumer credit." Consumer credit uses a different scoring model to rate an applicant for a retail credit card or a car loan. To be approved for a jumbo loan, borrowers typically need a low debt-to-income ratio, a high credit score and a substantial amount of cash reserves.

You need at least a 620 FICO Score to qualify for most loans from the online lender. Other mortgage companies may be willing to approve borrowers with a credit score of 580. Let's say you're hoping to get a 30-year fixed-rate mortgage loan for the average mortgage balance of $236,443. While credit score requirements vary based on loan type, mortgage lenders generally require a 620 credit score to buy a house with a conventional mortgage.

No comments:

Post a Comment