Table Of Content

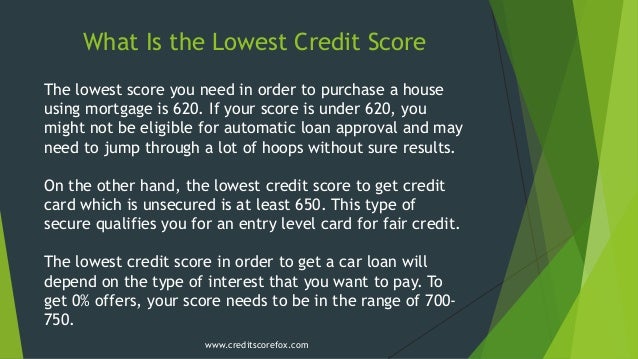

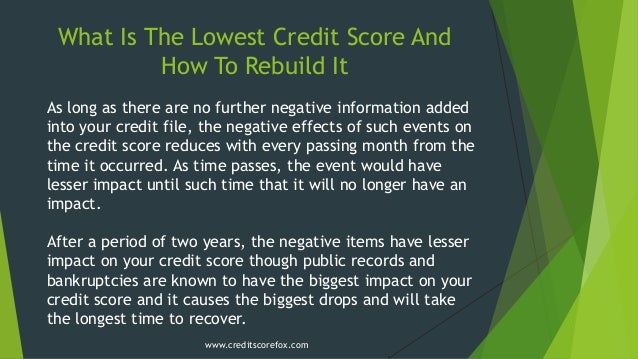

Improving your credit score to buy a house may involve paying down debts, correcting any errors on your report, and ensuring timely bill payments. A good credit score to buy a house is typically around 620 or higher, especially for conventional loans backed by Fannie Mae or Freddie Mac. This score range increases your chances of approval and can secure more favorable loan terms.

Correct errors on your credit report

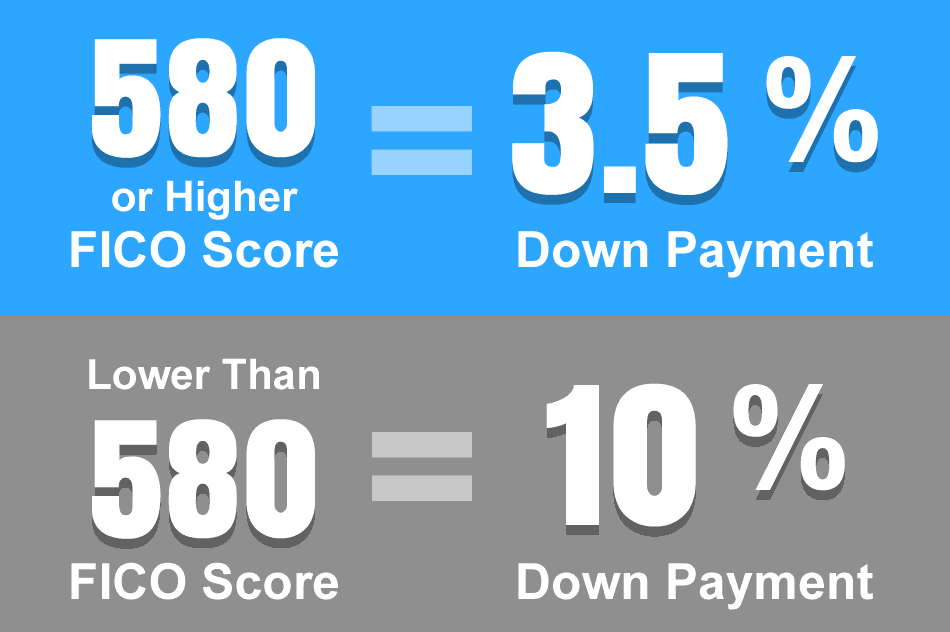

Borrowers with low credit scores may wish to consider alternative options because a conventional loan would most likely have higher interest rates and fees. An FHA mortgage is a government-backed loan guaranteed by the Federal Housing Administration. You can qualify for an FHA loan with a low credit score of 500 and a 10% down payment, or 3.5% down if your FICO is 580 or above.

Additional Factors Lenders Consider For A Mortgage

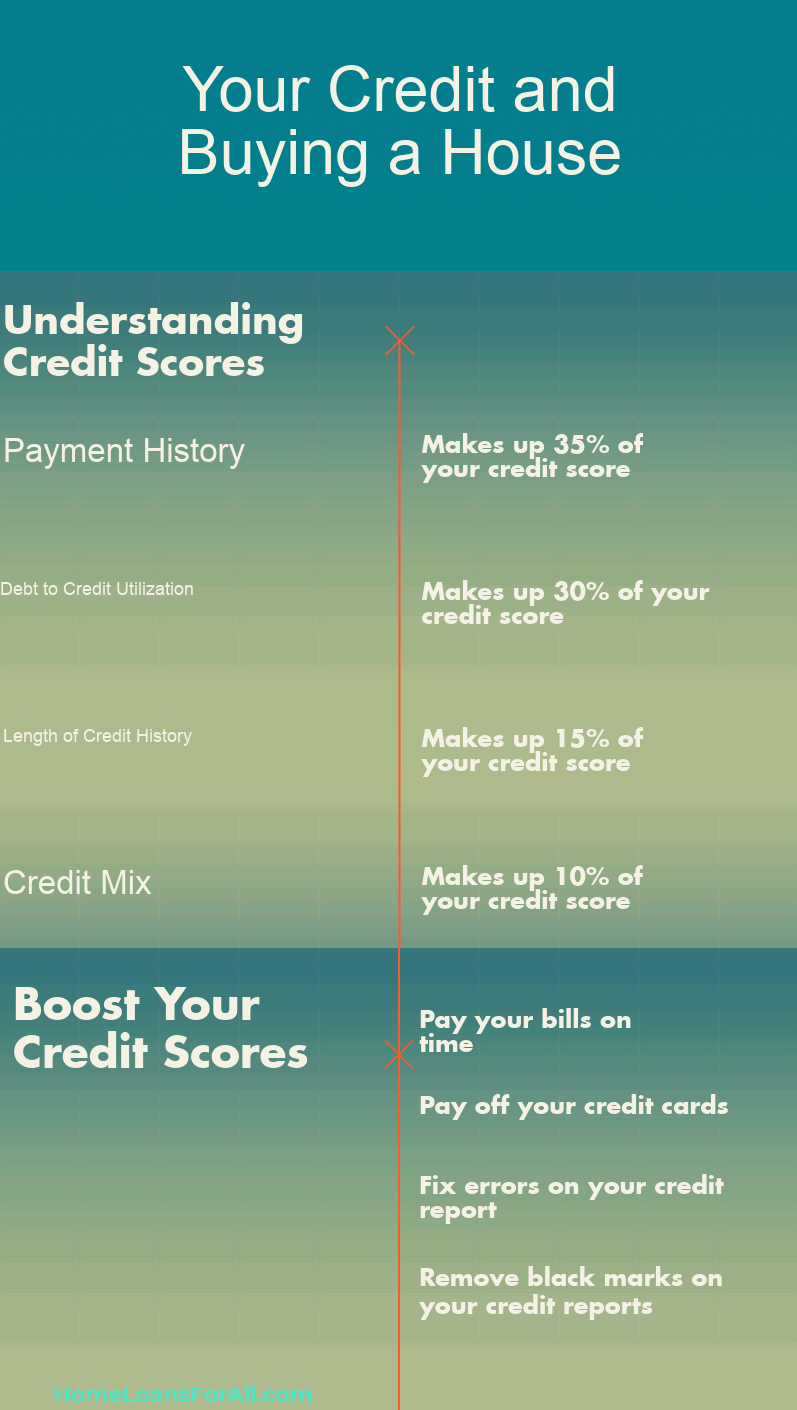

It's important to point out lenders are free to set higher minimum credit score requirements than what the loan-backing organizations require. Some lenders may require a minimum score of 660 for conventional loans, or a score of 580 for a VA loan, for example. Reducing your overall debt is crucial to improving your credit score. Focus on paying off high-interest debts first, such as credit card balances or student loans. This not only lowers your debt-to-income ratio but also demonstrates your creditworthiness to lenders. However, borrowers with a lower credit score may face a higher interest rate and the cost of private mortgage insurance (PMI), especially with less than 20% down.

Mortgage Rates by Loan Type

What Credit Score Is Needed To Buy A House? - Forbes

What Credit Score Is Needed To Buy A House?.

Posted: Tue, 23 Jan 2024 08:00:00 GMT [source]

When you get your reports, pick through them carefully and verify the info you see. If you spot errors, like a delinquent account listed that is actually in good standing, you can dispute them with the credit bureau and have them removed. Errors are frighteningly common -- according to Consumer Reports, 13% of Americans have errors that impact their scores. Generally, a co-borrower is someone who would purchase the home with you and would be listed jointly on both the loan and the title. A co-signer, on the other hand, is someone who agrees to take responsibility for the loan if you can’t repay it. Technically, both a co-borrower and co-signer have the same financial responsibility, but whether you use a co-signer or a co-borrower can affect who owns the property.

If you’re unable to qualify for a mortgage due to a low credit score, you might want to consider bringing a co-signer into the equation. A co-signer essentially vouches for you, making lenders more comfortable with extending credit your way. In essence, you’re leveraging another person’s higher credit score and financial stability to boost your chances of securing that loan. Lenders evaluate your debt-to-income ratio, or DTI, to determine if you can afford a new monthly mortgage payment. Reducing existing debts before submitting a mortgage application can make qualifying for a home loan easier. USDA loans are popular with home buyers in qualifying rural areas because they offer zero-down payment options and competitive mortgage rates.

Check your credit score so you know where you stand, review your credit history to make sure it’s accurate and remember to consistently pay your bills on time. You can check your credit score for free with our tool if you’re a current U.S. There are many loan types and mortgage lenders that allow lower scores.

Errors on your credit report can unfairly lower your score, affecting your loan eligibility and interest rates. Regularly checking your report and correcting errors promptly is a key step towards maintaining a healthy credit score. If your credit score is weak but you have a stable income, a lot in savings, and a manageable debt load, you’re more likely to get a mortgage approved.

Cheap Methods for Boosting Your Credit Score When Buying Your First Home

Additionally, depending on the loan program, borrowers may be eligible to purchase a home with credit scores as low as 580 with Rocket Mortgage. Most lenders, though, reserve their most competitive interest rates for borrowers with higher credit scores. Zillow Home Loans could be worth considering if you have at least a fair credit score and you prefer a convenient, online mortgage experience. The online lender requires a minimum FICO Score of 620 or higher from its borrowers—criteria that’s slightly stricter compared to some competitors.

What’s the Minimum Credit Score to Buy a House?

The minimum credit score needed for most mortgages is typically around 620. Our mortgage loan officers can help you figure out what mortgage options would best fit your situation and lifestyle. The lowest credit score typically required to buy a house is 500 with an FHA loan, which requires the borrower to make a 10% down payment.

When comparing home loans for bad credit, evaluate the loan terms, interest rates, and monthly payments to determine which suits your personal finances best. A larger down payment can reduce your loan-to-value ratio, potentially resulting in better loan terms, lower interest rates, and the avoidance of mortgage insurance. It also shows lenders your commitment and financial discipline in saving towards homeownership. Your debt-to-income (DTI) ratio is an essential factor in the home-buying process. Lenders use this ratio to assess your ability to manage monthly payments and repay debts. Becoming a homeowner involves more than improving your credit score to buy a home; it requires a solid understanding of what lenders are looking for in your mortgage application.

Below, you can see the average TransUnion VantageScore 3.0 credit score of Credit Karma mortgage-holders in each state (plus Washington, D.C.). Now check out where the highest average mortgage balances can be found. Aim to take steps to improve your credit as far in advance of your house-hunting as you can. The longer you’ve had a strong score, the better, as far as lenders are concerned. Many people take steps before applying for a mortgage to spruce up their credit rating.

As you can see, payment history and amounts owed have the biggest impact, followed by length of credit history, new credit and the mix of credit accounts you have. When you apply with a spouse or co-borrower, the lender will use the lower of the two applicants’ middle credit scores. Understanding how your credit score to buy a house is determined is key to preparing for a successful mortgage application and home buying process.

When you apply for a mortgage, there are several key factors lenders look at during the underwriting process to determine if you’re a good candidate for a loan. While each lender and loan type may have its own requirements, you can expect these factors to be important in all cases. Lenders will obtain a tri-merge credit report to obtain the three FICO® Scores. Tri-merge reports combine information from each major credit bureau into one report.

Lower interest rates go to those with higher scores, which impacts how much you’ll pay in interest every month — the lower your score, the higher your rate is likely to be. Some home loan options are specifically designed for borrowers with less-than-perfect credit — so technically, yes, 600 can be a good enough credit score to buy a house. However, you may face a few hurdles on the way to homeownership, including higher interest rates and additional costs. Read on to understand what having a 600 credit score means for homebuyers, and why it might be wise to try to up that number before you start house hunting. Under such agreements, two parties exchange cash flows with each other. The lending bank will swap the variable payments it may make to service a mortgage (which is fixed to the SONIA rate) for payments at a fixed rate.

While this is below the typical requirement for conventional loans, it falls within the eligibility range for certain FHA loans, aligning with the credit score to buy a house. A credit score of 600 may mean higher interest rates or a larger down payment, but homeownership is still achievable. It represents the percentage of your monthly income that goes towards paying debts. Lenders use this ratio, in conjunction with the credit score to buy a house, to assess your ability to manage monthly payments and repay debts. A lower DTI ratio is preferable, as it indicates a good balance between debt and income, enhancing your chances of securing a favorable mortgage. Lenders typically seek a FICO score of 700–720, though some may consider scores as low as 680.

However, the online lender doesn’t offer USDA loans or home equity loans. Fans of in-person mortgages may also want to consider other options since Zillow Home Loans does not have any physical branches. Mary Beth is a freelance writer for Newsweek’s personal finance team. She specializes in explaining the ins and outs of mortgages and other loans, helping people to use debt wisely and build their credit. Based in Pittsburgh, Pa., Mary Beth is a proud alumna of Bowling Green State University, where she volunteers on the board of the Falcon Media alumni group. Michelle is a credit expert, freelance writer and founder of CreditWriter.com.